When I buy and sell shares, should I just click 'market price'?

19 August 2020

You should usually put in a limit price. Otherwise, you will get whatever other investors are offering - and there will usually be some poor value offers on the market.

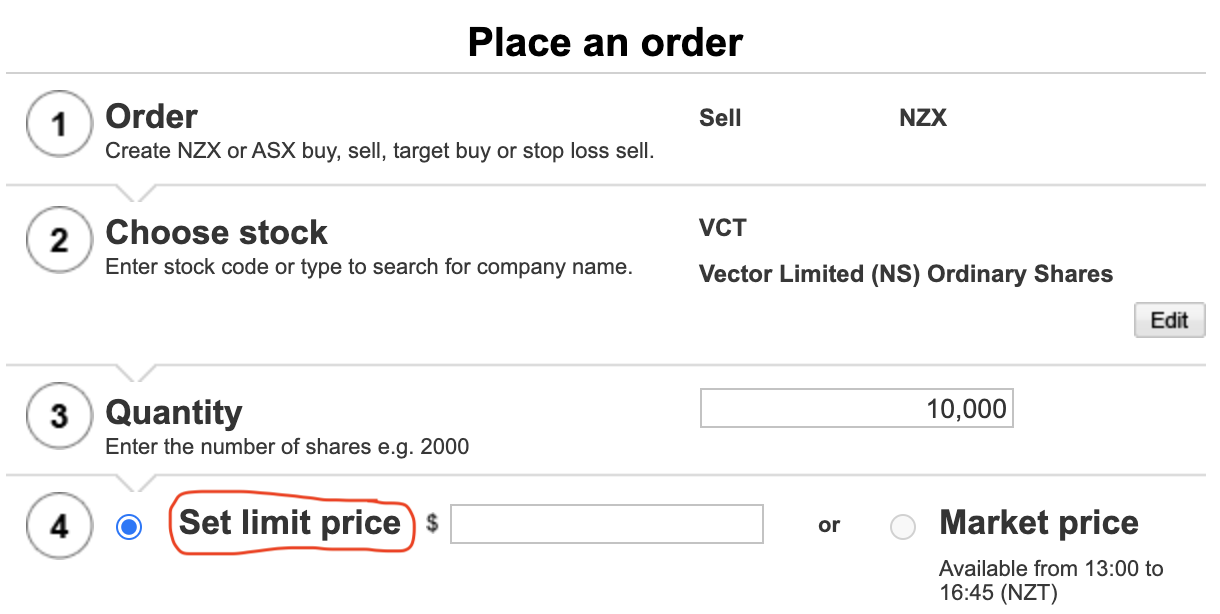

Setting a limit price

Selecting a limit price avoids this possibility. When you set a limit, your trade will be saved onto the market. When another investor offers shares for sale at this price (or a better price), then your trade will activate - and your purchase will be made.

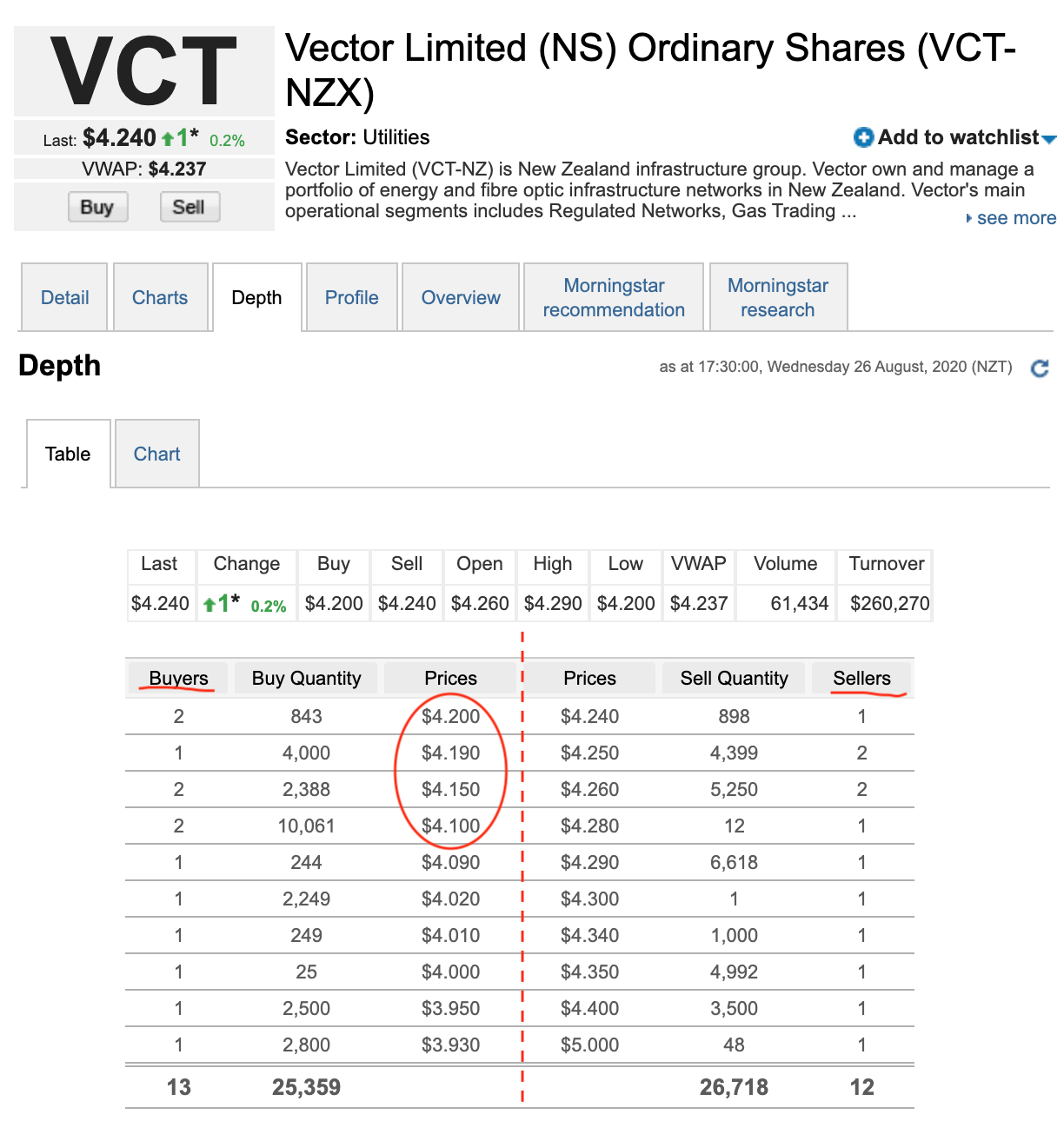

The market depth view in ASB securities (below) shows all outstanding buy and sell offers on the market.

Selling “at market”

If we wanted to sell 10,000 Vector (VCT) shares “at market”, they would (normally) trade immediately. The price we would sell at would be:

843shares at$4.204,000shares at$4.192,388shares at$4.152,769shares at$4.10

So you can see that we would not get a particularly great deal on these. But, if we set a limit price of $4.20, we would probably sell them “today” as the market price fluctuates during oer the day.

If we were not in a hurry to sell, then we could try setting a slightly higher price of say $4.25 or $4.30 but that may take several days or weeks to sell. Or may not even sell at all, so could be frustrating.

I normally will set a price whenever buying or selling that is marginally in my favour - but not too different. That is a nice balance between a speedy sale and a good price.

Note: the same logic applies when buying. I generally set a limit price at all times.